London Home Show Sponsors: Meet Tembo

How to tell when you’re ready – and how a home show visit can help

Buying your first home is a hugely exciting step – but it can also be an overwhelming process. If you’re hoping to buy in 2025, a home show can be the perfect place to start your journey.

This blog will guide you through some of the key considerations to think about before you take the leap, and how a home show will help you on your way.

Read on to find out more…

Is 2025 the right year to buy a home?

Before starting your home search, it’s important to understand what the housing market looks like in 2025. While predicting the market isn’t an exact science, here are some insights:

- House prices: House prices are expected to rise modestly in 2025 by 2.5%. While this is good news in terms of a stable market, it means that waiting until the end of the year to buy could make homes more expensive.

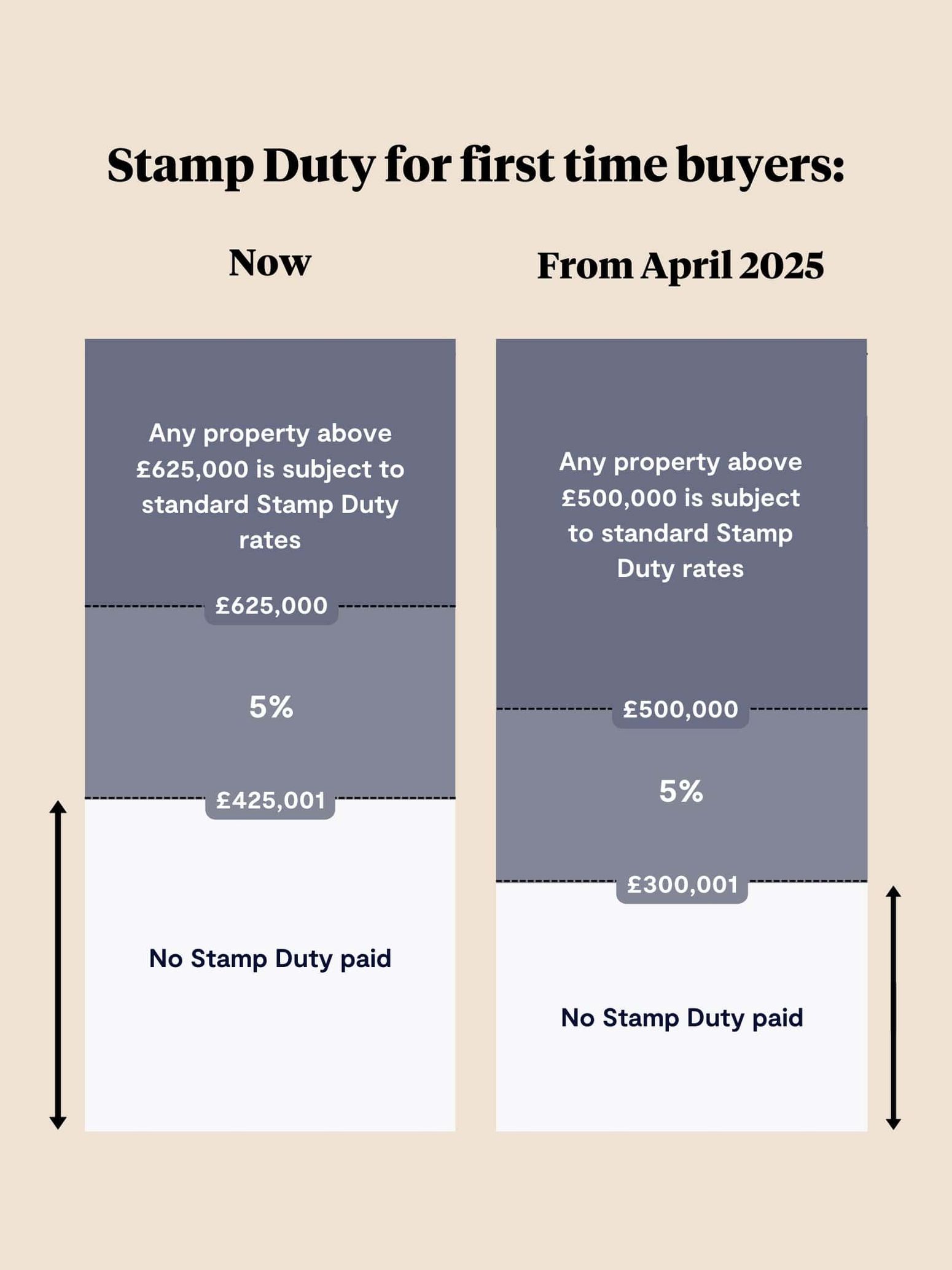

- Stamp Duty changes: New Stamp Duty thresholds are coming into play from 1st April 2025 and are expected almost double the average home-buyer’s tax burden from £2,768 to £5,268.

- Mortgage rates: Currently, experts are predicting that the Bank of England will cut the base rate over the course of 2025, which could help bring mortgage rates down during the year.

Are you financially ready to buy?

Buying a home isn’t just about finding the perfect property. It’s also about making sure you’re prepared financially for all the costs that come with buying a home. Here’s how to determine if you’re ready:

- Work out your budget: Start by calculating how much you can afford for your future home. A mortgage calculator can be a great help with this – as it’ll take into account your deposit savings and household income. On average, Tembo boosts home-buyer’s budgets by £88,000 vs other ‘standard’ mortgage calculators*.

- Credit score: A healthy credit score can improve your chances of securing a good mortgage deal. If your score needs a boost, work on paying off debts and avoiding missed payments. Read our guide on how to improve your credit score here.

- Savings: For most first time buyers, saving a deposit is the biggest hurdle. Consider opening a Lifetime ISA (LISA) to save up to £4,000 tax-free per year and receive the 25% government bonus to help you on your way*.

- Boost your affordability: With the rise of house prices, you might find that your budget doesn’t allow you to borrow the amount you need for a standard mortgage. Don’t worry – there are lots of other options out there – from ways to boost your budget to expert mortgage brokers like Tembo.

How home shows can help

If you’re looking to buy in 2025, a visit to a home show could be just what you need. Here’s why it’s worth attending:

- Find your dream home – see a wide range of properties to suit different budgets, whatever you situation.

- Get advice from the experts – chat to housing providers, book a 1-on-1 appointment with expert mortgage brokers, and grab a coffee with a conveyancer! We’re all there to help you understand your financial options and the home-buying process.

- Exclusive offers & giveaways – Don’t miss out on special deals and merchandise available only at the event. Home Show attendees who decide to open or transfer to a Tembo Cash ISA or Lifetime ISA will get £25 boost from Tembo*!

Start at the London Home Show

- When: Saturday, April 26 · 10 AM – 5 PM

- Where: Queen Elizabeth II Conference Centre, Broad Sanctuary, Westminster, London SW1P 3EE

Attend the London Home Show

Tickets for the London Home Show are free, but visitors must register in advance to attend. For more information, or to reserve your place at the capital’s no.1 first time buyer event, please visit the Eventbrite page.

Share to Buy lists thousands of affordable properties across the country, including those available through Shared Ownership, Rent to Buy, London Living Rent and Discount Market Sale. Learn more about the different buying and rental schemes available today.